The 4 year cycle is perhaps one of the most well known (and ignored) concepts in crypto. Every bull run many claim crypto has entered an up-only supercycle and every bear run pessimists swear it’s all going to 0. To understand what the 4 year cycle is and how it’s predicted every parabolic rise and devastating drop in Bitcoins price let’s first dive into some history.

A Recap on Bitcoin

Just after the 2008 financial crisis a pseudonymous computer programmer by the name of “Satoshi Nakamoto” published a white paper outlining the creation of a digital currency called “Bitcoin”. Bitcoin uses blockchain technology to create a secure decentralized network which prevents one entity from controlling it such as the government. This lets both users and developers be confident that corrupt officials or unfair laws cannot interrupt operations.

Instead of traditional databases where one entity had complete control over what was “true”, blockchains can only add new information when a majority of participants vouch for it. A blockchain is a database that is shared across a network of computers and once a record has been added to the chain it is very difficult to change. To ensure all the copies of the database are the same, the network makes constant checks.

There are two main participants that help the Bitcoin network: Miners and Nodes. Bitcoin processes changes in “blocks” or groups of Bitcoin transactions. These transactions are verified by miners who check if a transaction is true or not. The main purpose of mining is to establish a history of transactions that is impossible to change. In exchange for verifying the network and keeping it secure miners are paid through transaction fees and newly minted Bitcoin. While Miners create new Bitcoins, Nodes validate transactions and spread information about them. Nodes are only paid a reward for offering their information and can’t mine new Bitcoins. By downloading and verifying the blockchain, Bitcoin nodes are able to reach a consensus about the ordering of events in bitcoin.

Why this Matters

Understanding how mining for Bitcoin works is essential as it is the sole way inflation of Bitcoin is distributed. Instead of money printers Bitcoin has mining to distribute its currency. Bitcoin has a max total supply of 21 million and every 210,000 blocks or ~4 years mining rewards of Bitcoin is cut in half. It started with 50 Bitcoin per block being minted back in 2009 and after 3 halving events has reached 6.25 Bitcoin per block.

Currently 900 Bitcoins are minted daily and next year another halving will start and this will drop to 450. The halving is important due to simple supply and demand principles. When new supply and sell pressure from miners drops by 50% even if demand remains stagnant then price will increase. Out of the 21 million max supply Bitcoin is already at 19.4 million, only an 8% further increase of supply. This price momentum can trigger a multi year bull market for crypto.

Liquidity Spreads

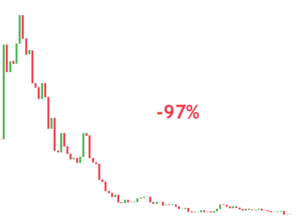

As the bull market matures liquidity spreads from Bitcoin to other coins. This occurs until the inflow of new funds into the crypto market cannot sustain the inflated prices of all crypto assets. Which leads to a dramatic downturn until the market starts ranging again before the next halving.

Understanding this simple cycle can put you miles ahead of other investors.