In 2021 the word of the year was NFT according to Collins Dictionary. The use of the word exploded by over 11,000% in a year. Many celebrities have embraced this new digital art world and spent millions purchasing the hottest collections. Beeple made history by selling his NFT for $69 million. Not a bad payday for an artist.

Credit: Beeple’s collage, Everydays: The First 5000 Days

But what are NFTs and why do I still prefer tokens? Well let’s dive in.

Nonexistent Fairy Tale

During the craze of the NFT bull market it seemed everyone and their grandmother was asking about it. NFTs have been complicated a lot, but the fundamental idea is quite straightforward.

NFTs stand for Non-fungible tokens and before I lose you let’s break this term down. The word fungible means interchangeable. For example, a dollar and a gallon of gas is fungible.

If you borrowed a $10 bill from your friend and paid back a different $10 bill, it wouldn’t matter. A dollar is a dollar and it doesn’t matter if the exact bill is different as long as it’s the same amount of money.

Now since an NFT is non-fungible this means it’s not interchangeable. Real world examples are famous artworks like the Mona Lisa. If you borrowed your friend’s car and returned a different one, your friend would be pretty upset because that’s not the right car.

Credit: Sketch Planations

Now onto the last part, tokens. In simple terms, a token means it can be verified on a secure blockchain, and it cannot be replicated.

Each NFT has only one owner and its own ID which makes it easy to differentiate from others. The most common type of NFT is artwork but it can also represent other unique assets such as virtual land in a blockchain-based game.

NFT vs Regular Token

While NFTs are one of a kind, fungible tokens or usually called just tokens, are an interchangeable medium of exchange created on blockchains. USDT, the $80 billion stablecoin, mirrors the value of a United States dollar. So 1 USDT = $1.

Tokens are also commonly used in many aspects of decentralized finance. One of those applications is decentralizing control over a protocol. This allows token holders to vote and influence a project’s future.

I prefer tokens mainly due to liquidity issues. Tokens are listed on exchanges to be traded and as a result have much deeper liquidity.

It is also much easier to invest in tokens rather than NFT collections. All tokens of a project are interchangeable and thus are the same. While in an NFT collection every NFT is different which makes it harder to value positions. What should the premium be for different traits in an NFT collection? Should a 50% rarer trait receive a 50% premium? Which NFT should be used as a baseline? Is an NFT under its fair market price relative to its collection if it differs from that premium? Is there any reason it’s forced to have that premium?

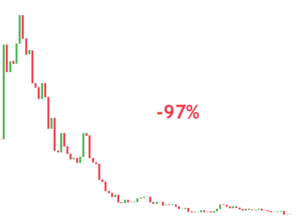

These logistical questions make it almost impossible to reasonably invest in NFTs with large amounts of capital. To have to consider these questions everytime we bought or sold an NFT makes it a nightmare. To top it off, not all NFTs in a collection increase the same proportionally.

For these main reasons tokens are a much friendlier investment that can handle a much more substantial amount of capital.

Although NFTs are an exciting part of the crypto space that generates retail attention, it may not be the most appropriate option for us at Zanshin Capital Management.